We’re the first new high street bank in over 100 years. Our mark was made in London, but since then we’ve set up shop all across the capital and beyond.

We have slightly different opening hours this festive season, and our stores will be closed on Christmas Day and New Year’s Day.

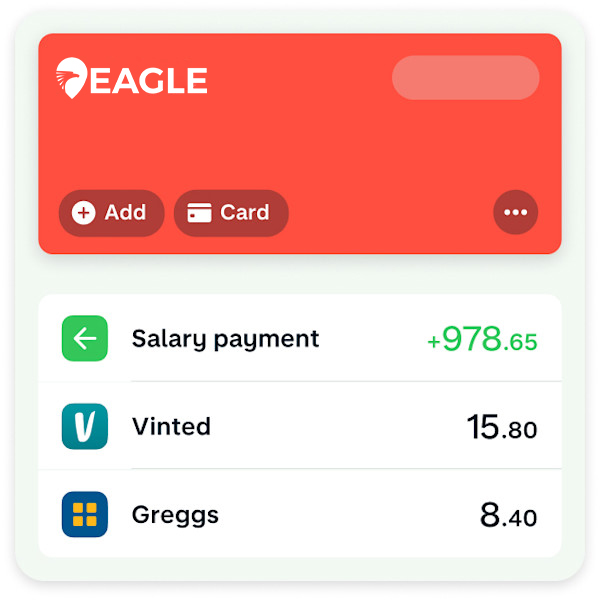

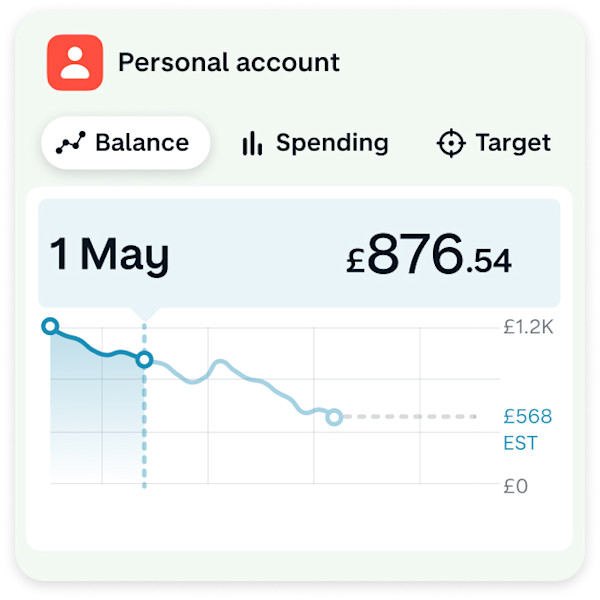

Log in to our app with your face or fingerprint, and manage your accounts with a tap. Plus, track your spending with our Insights feature.

Earn cashback. Get paid early. Split bills. Free yourself from travel fees.

Get a fully regulated United States current account on North America’s Best Banking App.

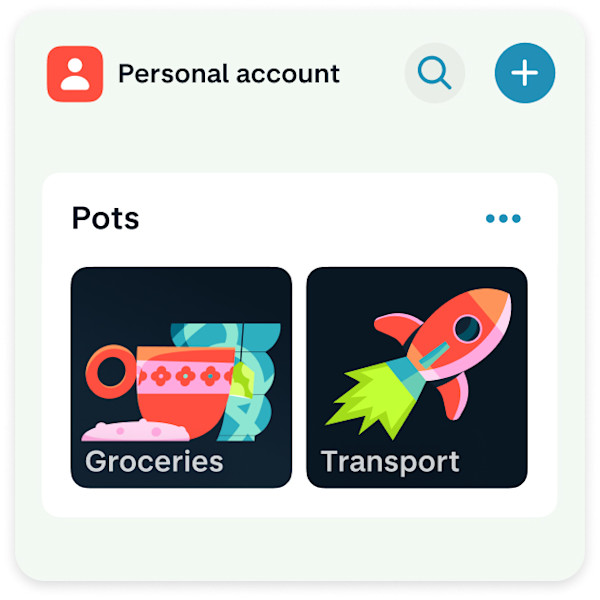

Make your account feel more you with custom Pots. Use them to separate your money, save, and sort bills.

Learn about your spending habits with weekly and monthly insights.

See instant notifications the second you pay. Then set budgets for things like groceries and going out, and get alerts if you’re spending too fast (if you want them).

Open an account for free

If you have an equiry relating to any of our stores, products or services, please get in touch to speak with someone in our USA-based contact centre and we'll be happy to assist you.

Get in touch

Looking for a New Year’s resolution you can actually keep?

Try the 1p Saving Challenge.

Start saving little and often – all in the app, all on autopilot. Start with 1p on day one and save your way to $667.95 by day 365. Complete the challenge and be in with a chance to win $10,000.

And the pen and paper – because we're the first USA bank to launch an automated 1p saving challenge.

Open an account

Manage your money with a fully licensed United States bank

Count on Industry-first security features

Budget and save in clever new ways

A Home Equity Line of Credit (HELOC) is a revolving line of credit that’s secured against your home. Common uses include repairs and upgrades to your home, paying down higher-interest rate debt and paying for tuition or other expenses. HELOC interest rates are variable and may change over time.

Principal & interest HELOCs are the most common. With this HELOC your minimum monthly payments during the draw period are made up of a combination of both principal and interest. You may choose to make additional principal payments at any time without penalty, to reduce your outstanding balance.

Interest-only HELOCs allow you to make interest-only payments on your outstanding balance during the draw period. Making interest-only payments means you're not paying down the principal and you might be surprised by the larger payments required during the repayment period. For an interest-only HELOC, you’ll want to find out if you meet eligibility requirements before you apply. You may choose to make additional principal payments at any time without penalty, to reduce your outstanding balance.

Authorised push payments (APP) fraud happens when someone is tricked into transferring money to fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in USA in 2022.

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.